Have you ever wanted to help out a family member with a financial need but weren’t comfortable with making an outright gift? If so, you may want to consider an intra-family loan.

An intra-family loan is exactly what is sounds like – a formal agreement between one family member to loan money to another family member for an agreed upon term at a fixed interest rate. While you must charge interest, the minimum rate prescribed by the IRS is typically much lower than that charged by commercial lenders. Before you jump in, beware that such a loan will introduce a business relationship to the family, so proceed with caution.

Who Should Use an Intra-Family Loan?

We typically see intra-family loans used by parents or grandparents who wish to help their kids or grandkids, but do not want to make an outright gift. For some, they do not have the cash flow to give away a lump-sum, while for others it may be to encourage financial responsibility on behalf of their child (i.e. “have some skin in the game”).

Another use is as an estate planning technique. By removing investable assets from one’s estate and replacing them with a low-interest rate loan, you are transferring that future appreciation to the giftee (assuming the loan proceeds are reinvested) and replacing that asset with a low-rate loan.

Benefits to Intra-Family Loans

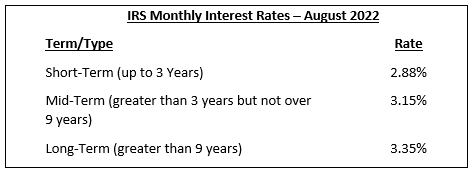

Low Interest Rates – The minimum interest rate allowed by the IRS is typically much lower than that charged by commercial lenders. In the chart below, you’ll see the minimum rates for August 2022 depending on the term of the loan. Note that these rates are reset monthly. Using August 2022 rates, you could loan your child a sum of money for 30 years and only charge 3.35%. That’s a pretty attractive rate in the current environment where mortgage rates are at 5% or higher in most markets.

Flexibility – You have options in structuring the loan terms. It does not have to be a traditional monthly payment of principal and interest. For example, the loan can be structured as an interest-only loan with a balloon payment at the end of the term or it can be structured with annual instead of monthly payments.

Money Stays Within the Family – Instead of paying a third-party lender, the interest on the loan is paid to another family member. This keeps the overall flow of money within the broader family unit.

Setting Up an Intra-Family Loan

First, you’ll need to draft a formal loan agreement along with a schedule of payments signed by both parties. You may wish to consult an attorney to help with the drafting.

Remember, actions speak louder than words. A formal loan agreement is only good if it is followed by the parties, so be careful about not collecting payments or not charging interest. This could result in the loan being deemed a gift by the IRS (see gift tax implications below).

Are There Tax Implications?

I thought you’d never ask!

Income Taxes

The lender will need to report the interest income received from the loan on his/her tax return just like interest income received from a bank account.

The borrower can deduct the interest if the loan proceeds are used in a tax-deductible manner (e.g. home purchase, business operations). If the borrower is using the loan to finance a home purchase and would like to deduct the interest, the debt should be secured by the home and recorded in accordance with local law. You’ll want to see if the tax benefit is worth jumping through those hoops.

Gift & Estate Taxes

Forgiveness of a loan payment is considered a gift and would count against your annual gift tax exclusion (2022 amount = $16,000). Anything above that amount would use some of your lifetime exemption (2022 amount = $12,060,000) and could impact your future estate tax liability.

What Are Some of the Downsides I Need to Know About?

Because a loan agreement is a legal and binding document, this will introduce a business relationship to the family. You’ll want to ask yourself how you’d react if the loan is not repaid or if you have to nag your child about repayment. You’ll also want to consider how other children may react if one child is getting a low-rate loan from mom and dad, but not them.

Intra-family loans will not help a child build up any credit history which could have a negative impact down the line.

Consult Your Wealth Advisor

In today’s rising interest rate environment, intra-family loans can be a way to provide low-rate loans to family members to pursue their goals or remove future appreciation from one’s own taxable estate.

While there is flexibility in repayment terms, a proper loan agreement should be drafted and followed. If considering an intra-family loan, reach out to your wealth advisor to help you weigh the pros and cons.

Schedule a call with a Marshall Financial CERTIFIED FINANCIAL PLANNER® professional to discuss intra-family loans.