Federal student loans are made by the federal government with the Department of Education serving as the lender. There are currently 3 types of federal loans available to help finance higher education. Depending on whether you are a parent or student, undergraduate or graduate student, one or more of these loans may be available to you. This article will explain the types of loans, how to apply for them, and recent federal student loan changes.

When considering student loans, it’s important to keep in mind that you can always borrow less than your school offers in their financial aid package. You can always request to borrow more at a later date, if need be. You should only borrow what you need.

Types of Federal Student Loans

Direct Subsidized Loans

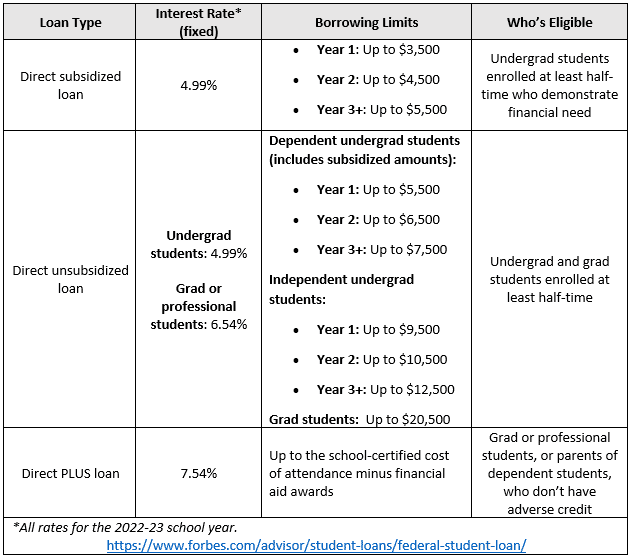

These loans are available only to undergraduate students with financial need who are enrolled at least half time. No interest accrues while you are enrolled at least half time plus a 6-month buffer period after you leave school. After that, interest starts accruing and repayment begins. The amount you can borrow is determined by your school and cannot exceed your financial need.

Direct Unsubsidized Loans

These loans are available to undergraduates, graduate and professional degree students enrolled at least half time. Financial need is not a requirement. While payments are not required while enrolled at least half time, interest does accrue during that time and is added to the principal of the loan that ultimately must be repaid. Like Direct Subsidized Loans, your school determines the amount you can borrow based on your cost of attendance and other financial aid you receive.

Direct PLUS

These loans are available to graduate students and parents of dependent undergraduate students regardless of financial need. The maximum PLUS loan amount you can borrow is the cost of attendance (determined by the school) minus any other financial assistance you receive. Additionally, there is a credit check required before obtaining the loan. Typically, these loans are meant to bridge the gap between the cost of attendance and the amount of Direct Subsidized and Direct Unsubsidized Loans received.

Key Differences

There are two key differences between Direct Subsidized/Unsubsidized Loans and Direct Plus Loans:

- Direct PLUS Loans require a credit check.

- Subsidized/Unsubsidized Loans are eligible for income-driven repayment plans, but Direct Plus Loans are not. However, you could consolidate a PLUS loan into a Direct Consolidation Loan to become eligible for the income-contingent repayment plan.

Applying for Federal Student Loans

To obtain any of these loans, you must complete the Free Application for Federal Student Aid (FAFSA®). For the upcoming school year (2022 – 2023), the FAFSA application will be available starting on October 1, 2022. Once completed, your school will provide you a financial aid letter outlining the loans you qualify for, however, you are not required to take the loans. We recommend completing the FAFSA® as soon as possible after October 1st.

Benefits of Federal Student Loans

- Federal loans have a fixed interest rate, typically below rates offered by private loans, that remain fixed over the life of the loan.

- Except for Direct PLUS loans, a credit check is not required.

- You are not required to make repayment until 6 months after you leave school (deferment can even be requested for PLUS loans, although interest will accrue during this period). Most private loans require immediate repayment.

- You may be eligible for income-based repayment plans and/or loan forgiveness.

Federal Student Loan Changes

For those of you who have federal student loans, you are probably aware that repayments (and interest accrual) are now paused through December 31, 2022 for one final extension.

Additionally, the Biden administration announced a student loan debt forgiveness plan, enacting more federal student loan changes. $10,000 will be forgiven in federal student loan for individuals making under $125,000 per year. For those who received a Pell Grant when attending school, an additional $10,000 will be forgiven per borrower. If you are unsure if you had a Federal Pell Grant while in school, you can log in to https://studentaid.gov/fsa-id/sign-in or https://nsldsfap.ed.gov/login to check your financial aid history.

Summary of Current Federal Loan Terms