Marshall Financial Group is in the business of helping you achieve financial wellbeing, so you can focus on creating a happier, healthier, and more productive life.

We’ve built Marshall to be a home for realizing your financial future. We provide a welcoming, open-minded environment where you can feel comfortable asking questions, exploring options and planning for what is most important to you. We meet you where you are, regardless of your level of financial knowledge. We listen, learn about your family’s hopes and dreams, and we create plans to mitigate risk, create opportunities and build long-term paths to achievement.

Through decades of working with entrepreneurs, businesses and families through multiple generations, we’ve developed a holistic “life planning” approach with the goal of helping you and your family achieve peace of mind. Our wealth management team can provide the support an resources you need to work toward your financial goals. You can utilize our reports and client portal to stay informed and connected.

No matter what life brings, your Marshall team will be with you today, and well into the future.

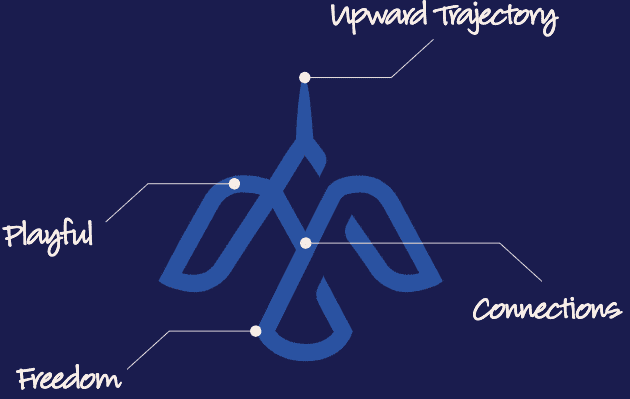

We choose to use the hummingbird to represent Marshall because it is a tribute to our promise to help our clients live their happiest, healthiest, most productive lives. The hummingbird is tenacious in pursuit of its dreams, it reminds us to seek what is good in life, and it adapts to change when necessary. This hummingbird was designed to show our passion for great client relationships as well as the upward trajectory and freedom of sound financial advice.

1977

Bill Marshall becomes one of the first people to earn CERTIFIED FINANCIAL PLANNER®

May 1981

1982

1986

1991

June 2012

October 2017

Marshall becomes a 100% ESOP (Employee Stock Ownership Plan)