As a financial advisor (and a parent) I often talk with families about the importance of financial literacy. But there’s one powerful tool that’s often overlooked: the humble summer job. For teenagers, a summer job is far more than a paycheck. It’s the starting point for developing lifelong skills, financial habits, and long-term wealth.

Yet, this summer may be tougher than usual for teens looking for work.

A Tougher Summer Job Market

According to a recent Marketplace article, teens are facing more difficulty landing seasonal jobs. A mix of economic uncertainty and enhanced automation (e.g., the grocery store check-out counter) has tightened the entry-level labor market. This might not sound like much, but it can have longer-term implications – limiting teens’ chances to earn, learn, and grow.

The Life Skills Teens Gain from a Summer Job

A summer job isn’t just about money – it’s a crash course in real life. Teens who work, even for just a few weeks, learn:

- Responsibility & Accountability: They’re expected to show up on time, follow directions, and handle consequences, perhaps for the first time outside the classroom or family. They may be able to cut a deal on doing chores around the house, but they can’t negotiate their way out of showing up for an 8AM shift.

- Time Management: Balancing work with sports, friends, or studying teaches teens to prioritize and organize their time. It also teaches them that sometimes they have to do things they don’t want to do – like go to work instead of a friend’s house.

- Communication & Professionalism: From speaking with customers to responding to supervisors, a job builds communication skills and professional etiquette. No more staring at their phone while they speak or saying “wait, I’ll do it later” when asked to do something.

- Financial Literacy: Nothing builds money awareness faster than earning it. Teens begin to ask: What’s direct deposit? What are taxes? Should I spend this or save it? These are ideal times to introduce concepts like budgeting, saving, and investing.

- Perspective & Empathy: One of my high school jobs was pumping gas at a gas station. My busiest days were – you guessed it – when it rained! I came home wet, cold, dirty, smelly, you name it. But it gave me a lasting appreciation for the people who do that work every day. When teens experience a tedious or thankless job early on, it shapes how they treat others later as coworkers and customers.

- Independence & Confidence: There’s a unique kind of pride that comes from earning your own money. It fosters self-worth and maturity. Earning your own money brings us to a hidden gem of summer jobs…

The Financial Secret: Funding a Roth IRA as a Teen

One of the smartest financial moves a teen can make with their summer earnings is opening a Roth IRA. Yes, really.

Here’s why:

- Tax-Free Growth for Life: Roth IRAs are funded with after-tax income, meaning growth and withdrawals in retirement are tax-free. For a teen who starts early, this can seriously add up over time.

- Low Contribution Thresholds: In 2025, teens can contribute up to $7,000 or their total earned income, whichever is less. That means even a part-time job qualifies. Just make sure you report that earned income on a tax return 😊.

- Flexibility: Roth IRAs allow penalty-free withdrawal of contributions (though not earnings), giving teens access to funds if needed for things like tuition and emergencies.

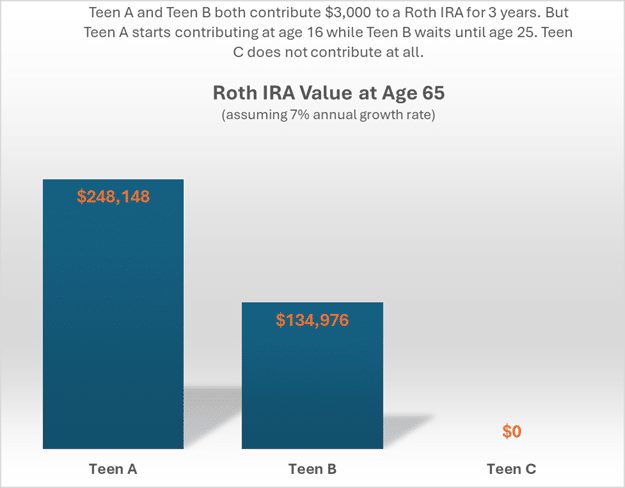

The Power of Compounding: My colleague Sean Dann already wrote a great blog post on this topic, so instead of repeating it, I’ll show you what it looks like in action.

Simply put, starting early makes a significant difference, even if the total contribution amount is the same.

Practical Tips for Parents and Teens

- Track earnings: Whether formal W-2 work or self-employment, make sure income is documented.

- Start small: Even $500 invested now can make a major difference later.

- Teach, don’t just tell: Involve teens in the account setup. Explain the concepts. Let them see the numbers.

- Consider a matching plan: If your teen earns $1,000, offer to match a portion they contribute to their Roth.

- Talk about taxes: Use their pay stub to explain Social Security, Medicare, and why saving early matters.

While the job market might be more competitive this summer, the long-term value of a teen summer job can be crucial to building financial literacy. From learning essential life skills to taking their first steps toward financial independence, teens gain more than just a paycheck – they build a foundation for future success. And with tools like a Roth IRA, that foundation can grow into lifelong wealth. If you’re wondering how to help your teen make the most of their earnings, or if you’d like guidance on how summer work fits into your family’s broader financial goals, we’re here to help. Reach out to our team to start the conversation.