Overview

A Solo 401(k), also known as an Individual 401(k) or One-Participant 401(k), is a retirement plan for self-employed business owners, including S-Corp owners, with no employees other than a spouse. It is also an option for those with second incomes, such as consulting.

Solo 401(k) Annual Contributions

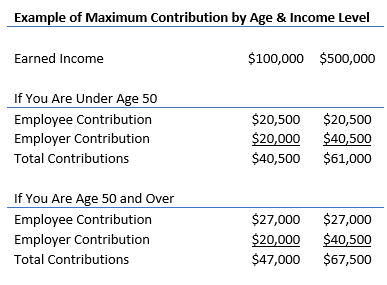

The Solo 401(k) operates in a similar fashion to a traditional 401(k) plan. It allows both employee and employer contributions up to a combined IRS limit of $61,000 (or $67,500 if age 50 and over) in 2022. Being self-employed, you wear both hats.

For 2022, you can make employee contributions equal to 100% of your income up to $20,500. If you are age 50 and over, you can also make a catch-up contribution of $6,500 for a total contribution of $27,000. Employee contributions can be Roth-style contributions, meaning they are made after-tax, but all future appreciation grows tax free.

Employer contributions are limited to 20% of net earnings but can be made so long as total contributions don’t exceed the current year IRS limit. Roth-style contributions are not allowed with employer contributions.

Using Solo 401(k) For a Side Job

If you have self-employment income from a side job (e.g. consulting) and you already contribute to a retirement plan through your full-time job, you can still contribute to a Solo 401(k). While the employee contribution limit of $20,500 is “per individual” and aggregated among plans, the total limit of $61,000 is “per plan.” Since a workplace 401(k) plan and Solo 401(k) plan are two different plans, this means they each have their own $61,000 limit.

For example, let’s assume you have a full-time job and participate in Company XYZ’s 401(k) plan. You also make $100,000 through a side consulting job. At Company XYZ, you make an employee contribution of $20,500 while receiving an employer profit-sharing contribution of $35,000 for total contributions to your Company XYZ 401(k) plan of $55,500.

How much can you contribute to your Solo 401(k) now?

While you cannot make any employee contributions since you already contributed the maximum $20,500 to Company XYZ’s 401(k) plan, you can still make an employer contribution to your Solo 401(k) equal to 20% of your earnings, or $20,000.

Your total retirement plan contributions would then equal $75,500 ($55,500 Company XYZ 401(k) Plan + + $20,000 Solo 401(k) Plan).

Solo 401(k) Reporting Requirements

While setting up a Solo 401(k) is relatively easy, once assets in the plan exceed $250,000 you must file Form 5500-EZ on an annual basis. Don’t be discouraged – the form is only two pages long and should be able to be filed for a nominal fee with a CPA.

Other Considerations

Solo 401(k) Loan – You can take a loan from your Solo 401(k) plan, just as you could with a regular 401(k). You can borrow the lesser of 50% of the plan value or $50,000. The loan must be repaid within 5 years, unless for the purchase of a primary residence. Solo 401(k) loan interest rates vary by plan sponsor, but are usually linked to the current Prime Rate plus 1% (as of September 2022, the Prime Rate is 6.25%).

Rollovers – Solo 401(k)s can be rolled over into other retirement plans, such as Traditional IRAs, and you can also rollover old retirement plans into your Solo 401(k). One key benefit here is consolidation.

Conclusion

If you are self-employed, a Solo 401(k) is an often-overlooked option for retirement savings. With high annual contribution limits and the ability to make Roth-style contributions, it can be a great tool to help maximize your retirement savings. You should also consider a Solo 401(k) if you have earned income from a side job and are looking to make additional retirement contributions above and beyond the limits imposed by your primary retirement plan.

Consult your wealth advisor to discuss if these strategies are the best options for you. Don’t have a wealth advisor or looking for a second opinion? Click here to schedule a no-cost consultation.