Many people don’t consider financial planning until a major life event occurs, like getting married, buying a house, or a major promotion. But a plan for wealth management can be helpful at nearly any stage of your life. A financial plan is a map for how you manage your money to achieve your life goals. Locally, Schwab’s 2019 Modern Wealth survey found that Philadelphia residents with a written financial plan feel 50% more financially stable than those without a plan, and they have healthier money habits for saving and investing.

Having a plan guides your everyday decisions about money so you can take care of yourself and your family now and in the future. It links today’s actions to tomorrow’s outcomes. With a financial plan, you can have more peace of mind and make decisions with more confidence.

What does a financial plan include?

A financial plan may include more than you would expect. It isn’t just about investing; it’s about your life and legacy. To help you live the life you want today and assist you in securing your future for tomorrow, you may want to consider incorporating these 12 elements.

#1: Goals for Your Life and Your Finances

Before you can create a map, you need to know where you want to go. Writing down your goals helps you remember them and motivates you to take action. Your plan should include your short-, medium-, and long-term life goals: what are your values, and what’s your vision for your life? Your plan will translate these into financial actions, like building an emergency fund, paying off a house, saving for college, and planning for a comfortable retirement. Having written financial goals that support your vision increases the likelihood of achieving the life you want.

#2: Your Current Financial Situation

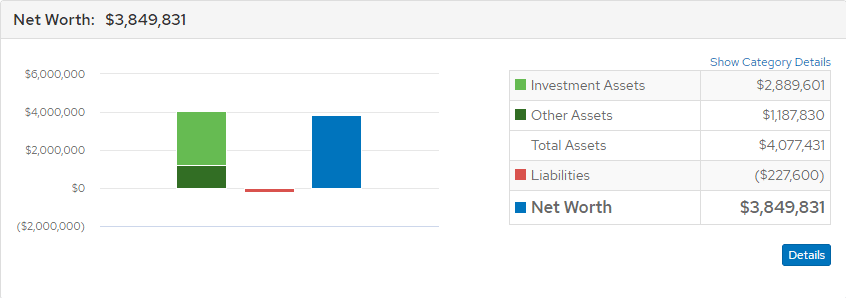

Action is the antidote to anxiety. If you’re feeling stressed about finances, the first step is to take stock of where you are now. How much do you own, and what do you owe? Your assets (what you own) include your bank accounts, investment accounts, retirement accounts, real estate, your car, and any other valuables you may have. Your liabilities (what you owe) may include your mortgage, student loan debt, credit card balances, car loans, or other money you owe. Your net worth is your assets less your liabilities. Your plan will also include your current income and expenses, as well as your cash flow.

Caption: Taking stock of your current financial situation includes assessing what you own and what you owe. For illustrative purposes only through MoneyGuide Pro software.

#3: Your Budget

The next part of your plan is creating a budget. We’ve found that many Americans don’t have clarity on how much they can afford to spend now versus saving for later. Your goals and your current financial situation will allow you to determine how much you should be saving, investing, and spending.

#4: Saving for an Emergency or an Opportunity

How much money do you need to access in the short term for an emergency or unexpected expense? Most experts say you should save three to six months’ worth of living expenses (rent or mortgage, grocery bills, car payments, etc.) in case of a medical emergency, a layoff, an unexpected home or auto repair or the like, or even more if you are a one-income household or have a volatile job. In addition, you may wish to save for a down payment on a home or another large purchase such as travel. Your plan will include the steps for building your savings, such as automating deposits to your savings account. This money generally has a low rate of return but is your financial cushion when you need to access funds quickly or for a short-term goal.

#5: Investing to Take Advantage of Time, Diversification and Consistency

Historically, investing has provided better returns than savings over time, so once you have built your savings fund, you should invest to earn more than you will in your savings account. A regular plan for contributing to a balanced portfolio is more likely to help you achieve your wealth goals and mitigates the impact inflation has on savings accounts. By accepting some risk, investments generally outperform savings over time.

For illustrative purposes only from Bankrate.com Simple Savings Calculator and Investing Calculator using $50K initial investment, $1K monthly investment, 0.1% savings return, 8% investment return over 30 years.

Having a plan for investing also allows you to take your personal risk tolerance into account when investing, whether you’re aggressive and primarily interested in a higher return, moderate and willing to take some risk, or conservative and emphasizing preserving principal. Schwab’s Modern Wealth survey shows that 75% of those with plans consider their risk tolerance when investing versus just 56% of non-planners. A plan helps your investments reflect your goals and how to get there.

For illustrative purposes only through MoneyGuide Pro software.

#6: Planning for Retirement

Do you know how much you need to save for retirement? Almost a third of people surveyed by Schwab in 2020 don’t know how long their retirement savings will last. How much you need to save now depends on your current age and life expectancy, your current lifestyle, and what you envision your life to be like in retirement. A general rule of thumb is to save 10-15% of your pre-tax income for retirement, or more if you are a high earner whose Social Security will not replace a significant portion of your income.

For illustrative purposes only through MoneyGuide Pro software.

#7: Tax Planning

How can you pay less in taxes, now and in retirement? Your plan will look at how to minimize taxes, from whether to contribute pre-tax income to an employer-sponsored 401K or health savings account or post-tax income to a Roth IRA, to estate planning to preserve wealth for future generations, to how much to withhold from your paycheck. In addition, taxes often rise or fall with a new administration, so your plan should capture any changes that come out of the new executive branch and Congress. These may include changes to income tax rates, long-term capital gains taxes, itemized deductions, and real estate tax treatments, among others. With planning, you can save on taxes now and in retirement so you can use that money towards your best life.

#8: Estate Planning

Your plan goes beyond budgeting for savings and investments. An estate plan specifies what happens when you die or are unable to make medical or financial decisions. It includes who will care for your minor children as well as how your assets will be distributed. It may include a device such as a trust to minimize estate taxes, preserve confidentiality, and protect your heirs from creditors.

Your estate plan will also address your wishes if you become incapacitated and cannot manage your healthcare or finances and will specify who makes decisions on your behalf.

#9: Risk Management/Insurance

Insurance is protection against uncertainty. If you were injured or died unexpectedly, what would happen to your family? If a friend hurts himself in your home, will your homeowner’s insurance be enough? Are you protected if you crash your car? As part of your plan, you should consider your insurance options such as health, disability, life, homeowners, auto, long-term care, and umbrella insurance. You’ll need to weigh the amount of coverage you need, how large your deductible would be, and how much you can afford to pay for premiums. Having appropriate insurance manages the risk of the unexpected decimating you or your family, and in some cases can be part of your savings plan.

#10: Real Estate

Real estate represents the largest segment of non-financial wealth for most households. Your plan will address whether you should refinance your home, or when you can pay off your mortgage. Has the pandemic made you want more space for your family or created a desire to live a simpler life? Can you buy a vacation home with the idea of moving post-retirement? Should you purchase a property to flip, for rental income, or for long-term appreciation? Real estate plays a large part of people’s day-to-day finances and dreams for the future. Your plan should look at the impact of owning real estate as part of your overall financial picture.

#11: Education Planning

U.S. News estimates the cost of tuition and fees ranges from close to $10,000/year at a public, in-state college to more than $35,000/year for private colleges and universities—close to $150,000 for a four-year degree from a selective private school, or nearly $250,000 at an Ivy League university. Have you saved enough to cover these costs? What can you provide for your children? What impact do your finances have on financial aid? What are student loan options for your child? Are you taking advantage of a 529 savings plan for college (or in some states, for K-12 private school tuition)? If you have children, your financial plan should address saving and paying for college.

#12: Regular Review and Adjustment

Schwab’s 2019 Modern Wealth Survey found that 85% of people who plan regularly rebalance their portfolios. This helps them stay on track to meet their goals. A good financial plan isn’t something you finish and file. A plan is a process that includes regular reviews and adjustments as needed to reflect changes in your circumstances, vision for your life, or the economy.

How to start your financial plan

There are many options for creating a financial plan. You can do it yourself. There are countless resources available, from articles to apps. Nerdwallet and SmartAsset have online resources about planning, and apps like Mint, YNAB, and Goodbudget can help with budgeting.

You may wish to work with a professional advisor if:

- You want someone to help you think about and set clear goals.

- You want to reduce the complexity of your financial life.

- You’d like to reduce your worry, guilt, and decision fatigue around money.

- You have limited time to manage your investments.

- You’d benefit from having an accountability partner to keep you on track.

- You want an objective viewpoint on your financial options today and in the future.

- You’d feel more confident with a trusted advisor.

- You want a resource for questions and advice about the financial elements of taking care of your family, your career, and your community.

Source: Charles Schwab 2020 40(k) Participant Survey Retirement Saving and Spending September 2020

At the end of the day, while having your finances in order may provide peace of mind, a plan is a means to an end—living a full and healthy life. Through decades of working with entrepreneurs, businesses, and families through multiple generations, Marshall Financial Group has developed a holistic “life planning” approach that helps bring peace of mind to you and your family. Marshall wealth advisors partner with busy professionals to help you mitigate risk and make informed decisions to help you enjoy your wealth today, while helping you create confidence in your future. To learn more about Marshall or to get started, visit https://www.marshallfinancial.com/get-started/.