The average worker will change jobs 12 times in a lifetime.* Through multiple job changes, it’s not unusual to have multiple, employer-sponsored retirement plans which might represent the bulk of your savings. Given how stressful and overwhelming it can be to start over at a new company, deciding what to do with a 401k from your previous employer is probably the last thing on your mind on day one. And by the time you’re into the routine of your new job, your old 401k will be a distant memory.

It’s a lot like the Law of Inertia: A body at rest stays at rest. We humans are hard-wired to stick with the status quo, especially when it comes to something we view as complex and without short-term consequences. Your 401k fits both criteria.

That’s unfortunate, because deciding what to do with your old 401k could have a big impact on your preparedness for retirement.

Why We Leave These Accounts Behind

Most companies allow you to leave your 401k in place after you depart. Their only obligation is to send you statements—not provide impartial advice. Meanwhile, you can’t count on HR at your new company to mention your old 401k during orientation. And since you usually can’t begin contributing to the plan right away, the 401k topic isn’t likely to be top of mind then.

If you weren’t at your former company long and your 401k balance isn’t large, deciding what to do with it might not be high on your priority list. Even if your account has grown considerably, you might perceive it’s too much work to do anything other than leave it alone—or perhaps you just don’t know what your options are. But the more wealth you have tied up in a 401k, the greater the consequences if you simply “set it and forget it.”

Why It’s a Problem

Most 401k plans offer limited investment options, which in turns limits the degree of diversification you can achieve. Depending on your investment objectives, your risk tolerance, and the number of years until you plan to retire, a lack of diversification could keep you from achieving your retirement goals. At the same time, some 401k plans charge high management fees that may or may not be justified by their annual returns, potentially eroding your balance.

If you’re paying a lot for mediocre performance, and your account isn’t diversified enough to match your investment objectives, risk tolerance, and retirement time horizon, then leaving your old 401k behind probably isn’t the best approach.

So, What Are My Other Options?

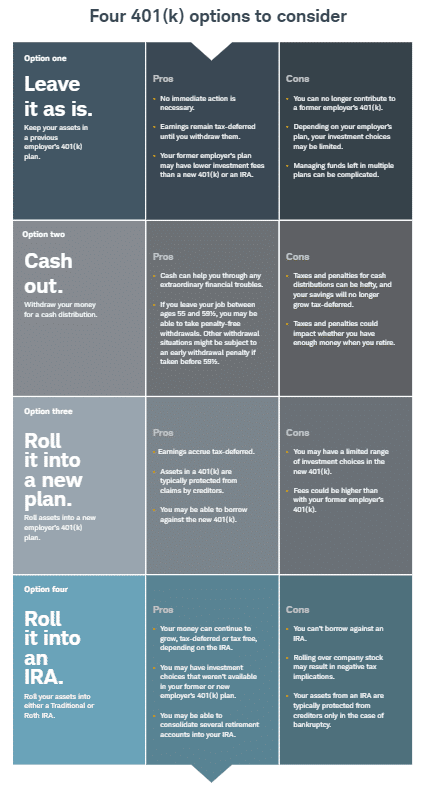

If you don’t want to leave your 401k with your old employer, you have several other choices to help you plan for your future.

1) Roll it into your new employer’s 401k. Assuming your new employer’s plan accepts rollovers, this approach can be advantageous if the new plan has a broader range of investment options and a more cost-efficient fee structure. In that case, moving the account over can help you achieve greater diversification and potentially higher returns. You’ll gain a more complete picture of how you’re tracking toward retirement if all your retirement assets are consolidated in one place. Additionally, 401k funds are typically protected from creditor claims.

Before taking this approach, get the Annual Disclosure Agreement for both plans, which you and your financial advisor can use to compare the performance and cost-effectiveness of your old plan vs the new plan. Keep in mind that once you roll the funds into a new employer’s 401K, those funds must remain in the new plan for as long as you stay with the company. In the process, you’ve lost the chance to diversify your retirement account beyond any constraints of the new plan

2) Roll it into a traditional or Roth Individual Retirement Account (IRA). This approach offers the same consolidation benefits you’d gain by rolling the funds into a new 401k, with the bonus of providing a nearly unlimited array of investment options. With more funds to choose from, you can diversify your investments more broadly and select funds with a cost-efficient fee structure that would include advisory fees. When you roll 401k funds into an IRA, you can benefit from the help of an experienced financial advisor to actively manage the new plan. Ideally, your advisor should be a fee-only professional who is also a fiduciary—ensuring he/she is obligated to operate in your best interests, limiting the conflicts that could interfere with recommending the best funds for your life goals. Rolling the funds into an IRA actively managed by a financial advisor enables you to enjoy more personalized service (including investment advice and transaction processing), greater flexibility in leaving the funds to your heirs, and the potential to make penalty-free withdrawals for certain expenses, like education, housing, or medical.

Before taking this approach, consider whether a traditional or Roth IRA is best. If you convert one or more 401ks to a traditional IRA, the funds will continue to grow tax-deferred and you’ll have to take required minimum distributions (RMDs), just as you would with a 401k. If you roll one or more 401ks into a Roth IRA, you’ll pay tax at the time of the conversion, but after that your funds will grow tax-free and you won’t have to take RMDs. You’ll want to understand any limitations, such as early withdrawal penalties, transaction costs, or restrictions on converting a traditional IRA to a Roth IRA later if you choose. And keep in mind that, unlike a 401k, you can’t borrow against an IRA.

3) Take a cash distribution. If you decide to cash out your 401k, the funds will be taxed as ordinary income at that time, with a mandatory 20% in federal tax withheld automatically. If you’re younger than 59½, you also may owe a 10% penalty. Additionally, you’ll lose the compound growth that results from keeping your investments growing tax-free

Choosing what to do with a 401k from a former employer is a major decision, and there is no single correct answer. The right choice for you depends on your financial situation and your life goals, so it’s best to consult with a CERTIFIED FINANCIAL PLANNER® professional first.

If you’ve left one or more 401ks behind with former employers and you want to determine your best course of action, contact the fee-only advisors at Marshall Financial Group.

* US Bureau of Labor Statistics 2019 survey