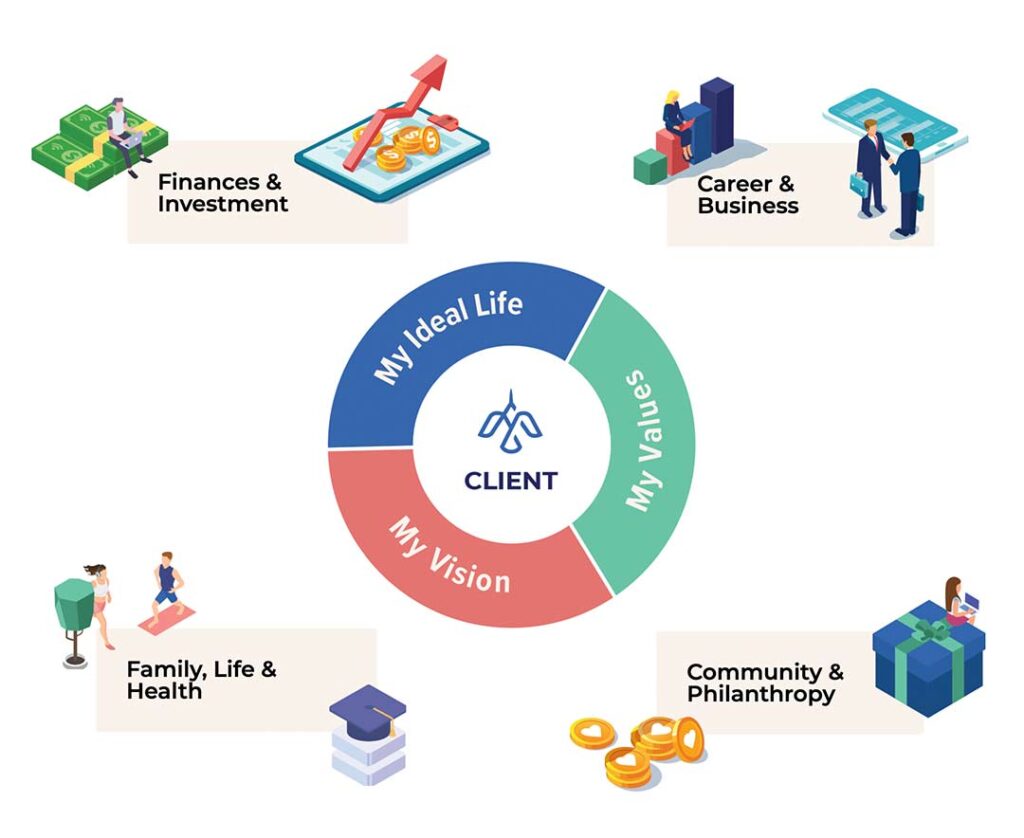

While a comfortable retirement may be your ultimate ambition, you have a lot of living to do in the meantime. We help you manage today and strive to achieve your ideal tomorrow.

Integrated Financial Services consisting of:

As you pursue happiness and independence, we help you mitigate risk and make informed decisions to help you enjoy your wealth today and strive toward peace of mind about your future.

At Marshall, we align our culture, values, and commitment to our clientele. As fiduciaries, all Marshall CFP® professionals are committed to putting your interests first, which is why we have a 100% Employee Stock Ownership Plan* and fee-only service model.