The tail wagging the dog – the smallest or least important part of something in control of the larger or more important elements; a reversal of typical roles or dynamics of power.

– The Free Dictionary (https://idioms.thefreedictionary.com)

This blog post may seem strange coming from a CPA who spent the first half of his career providing tax advice and preparing tax returns, but if there is one thing I learned from that part of my life it’s this – don’t let the tax tail wag the dog!

So what does it mean when you let the tail wag the dog? It means you let the small stuff (e.g. “I had a bad day”) control the bigger picture (e.g. “my life is ruined”). In the personal finance world, it could mean stressing out about buying an overpriced cappuccino from Starbucks while you live debt-free and save 10% of your income. In other words, you’re doing fine. Don’t sweat the small stuff.

When it comes to taxes, tax planning is one spoke on the wheel of overall wealth management. You want all spokes to be working together.

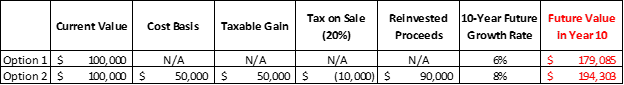

Let’s say you hold a mutual fund (Fund 1) worth $100,000 that you bought for $50,000. The fund has been underperforming and has an expected future growth rate of 6%. You have the chance to sell the fund and reinvest in another fund (Fund 2) with an expected future growth rate of 8%. But you’re hesitant because you don’t want to pay the tax (in tax speak, this is known as the “lock-in effect”). The right way to approach this is to ignore the short-term cost and focus on the long-term after-tax value. As you can probably guess, the math favors selling Fund 1 and reinvesting in Fund 2 despite paying a 20% tax to do so.

This isn’t to say that tax planning is a waste of time, or you should ignore it. It’s to say that we do tax planning to achieve higher after-tax wealth. If Fund 2 didn’t earn 8% and instead earned 6% (the same as Fund 1), you would have been better off avoiding the tax and holding on to Fund 1.

The takeaway of this blog post is to emphasize the importance of focusing on the big picture (wealth management) and to not let smaller items (e.g. taxes, investments) overshadow that. You’d never give up $1 to save $.30 in taxes so remember…don’t let the tax tail wag the dog!