When markets drop, most investors feel the urge to retreat. But for those who plan ahead, a downturn can create one of the best opportunities in retirement planning: the Roth conversion.

Let’s walk through a real-world example of how timing a Roth conversion during a market dip can dramatically increase long-term, tax-free growth.

The Scenario: Same Amount, Very Different Outcomes

Go back to 2020. Imagine two investors – both 65 years old, retired, and both with $100,000 in a traditional IRA invested in the Vanguard S&P 500 ETF (VOO). Their goal is to convert that money into a Roth IRA to take advantage of tax-free growth in retirement.

Investor A was proactive and converted on the first trading day of the year – January 2nd. He wound up with 335 shares in his Roth IRA.

Fast forward a few months, and the world looked very different. The pandemic sent markets into a tailspin. On March 23, 2020, the day the S&P 500 hit its low point, Investor B converted $100,000 to a Roth IRA. He wound up with 492 shares in his Roth IRA.

| Investor A (Converts on January 2, 2020) | Investor B (Converts on March 23, 2020) | |

| Stock Price (VOO) | $298.42 | $203.27 |

| Amount Converted | $100,000 | $100,000 |

| Shares Acquired in Roth IRA | 335 shares | 492 shares |

They both converted the same dollar amount. But because Investor B acted when the market was down, he walked away with nearly 50% more shares.

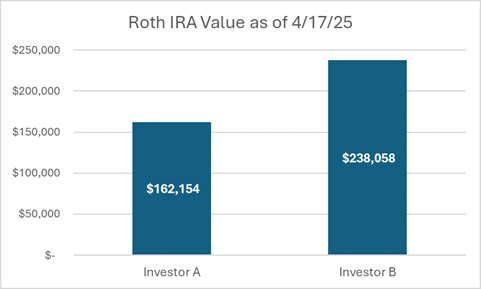

Now let’s fast forward again – to today.

The S&P 500 has recovered – and then some. With the Vanguard S&P 500 ETF closing at $483.90 on April 17, 2025 , here’s how their Roth IRAs have grown:

That’s a difference of over $76,000 — on the same initial investment. And all of that growth? Tax-free.

Why Roth Conversions Work

Roth conversions during market downturns are powerful because:

- More Shares = More Growth

Depressed prices mean you acquire more shares for the same dollar amount. When the market rebounds, those gains are amplified. - Tax-Free Forever

All future growth and distributions are tax-free in a Roth IRA and there are no required minimum distributions (RMDs) during your lifetime.

What to Consider Before Converting Your IRA

- You’ll owe income tax on the amount converted — ideally, use cash outside your IRA to pay it.

- Large conversions can impact Medicare premiums and other income-based thresholds.

- You don’t have to convert all at once — partial conversions over several years can be more tax-efficient.

Roth Conversions During Market Downturns

You can’t predict market drops, but you can prepare for them. A well-timed Roth conversion during a downturn can transform temporary market pain into a long-term financial win.

If you’re curious whether this strategy makes sense for you — especially in today’s uncertain market — let’s talk. We can run the numbers together and make a plan before the next opportunity passes.