America’s Most Haunted

If you are a fan of Halloween, you are almost certainly familiar with Salem, Massachusetts.

Known as one of the most haunted towns in the country, more than 1 million spook-seeking guests will descend upon the small, sleepy New England suburb this month to explore the site of the infamous Salem Witch Trials of 1692.

Just over 330 years ago, after a group of young Salem girls became sick with an unexplained “affliction,” many townspeople blamed the illness on the “witchcraft” practices of roughly 200 fellow residents. Several of these “witches” were sentenced to death and dozens of innocent lives were ultimately lost as a result of the hysteria.

Despite this being hard to fathom today, the incident revealed some glaring stumbling blocks that still interfere with our ability to think logically: confirmation bias and groupthink.

Confirmation bias occurs when people seek out or interpret information to support their existing views, while groupthink is the tendency to conform your views to align with those in your tribe.

In Salem’s Puritan culture, many believed witchcraft was a punishment for sinners handed down from God. And importantly, most of the accused witches were already not well liked by the broader community.

By conveniently (and incorrectly) convincing themselves that the girls’ sickness was the result of witchcraft, confirmation bias allowed Salemites to believe they were actually doing the right thing, while the religion’s strong preference for assimilation forced everyone to quickly fall in line.

Keeping it (Too) Simple, Stupid

Unfortunately, despite the massive advances in science and general education since the 17th century, we simply can’t help ourselves from falling into the same traps in 2024.

Just look at this year’s presidential election cycle. The examples of confirmation bias and groupthink are as glaring and damning as what we saw in Salem 330 years ago!

Both parties bend facts and seek out incomplete information to mold narratives in their preferred candidates’ favor.

The most frustrating (and scariest) part of it all? The wild misinformation and sensationalism around the stock market and the economy.

Each party wants to convince you a vote for them is a vote for stock market gains while a vote for their opponent threatens to send us into another Great Depression.

Fortunately, it is not that simple (nor dramatic), and if history is any guide, whether we end up with a Republican or Democrat in office is unlikely to predict which way stocks and the economy will go.

Stocks Like to Go Up

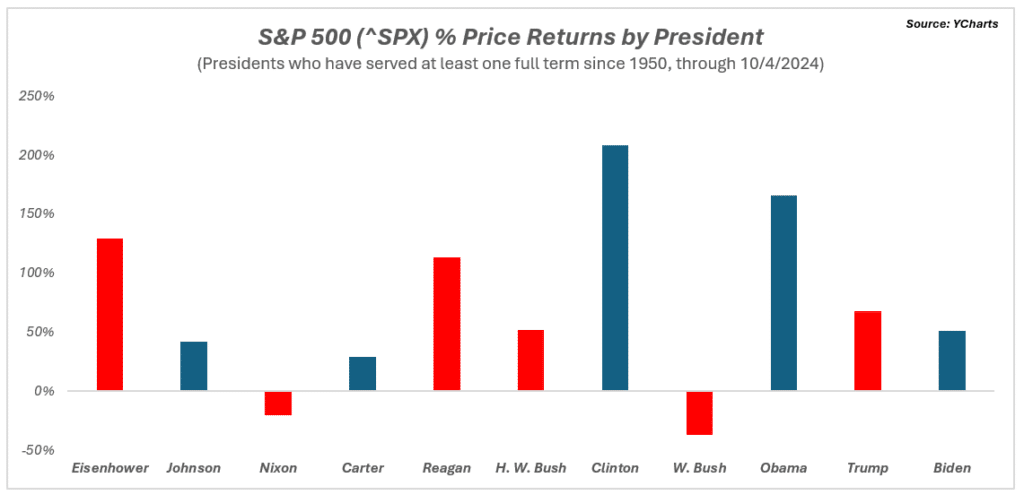

Since 1950, we have had 14 total presidents.

7 Democrats, 7 Republicans.

Only 2 saw negative S&P 500 price returns from the time they were inaugurated to the time they left office.

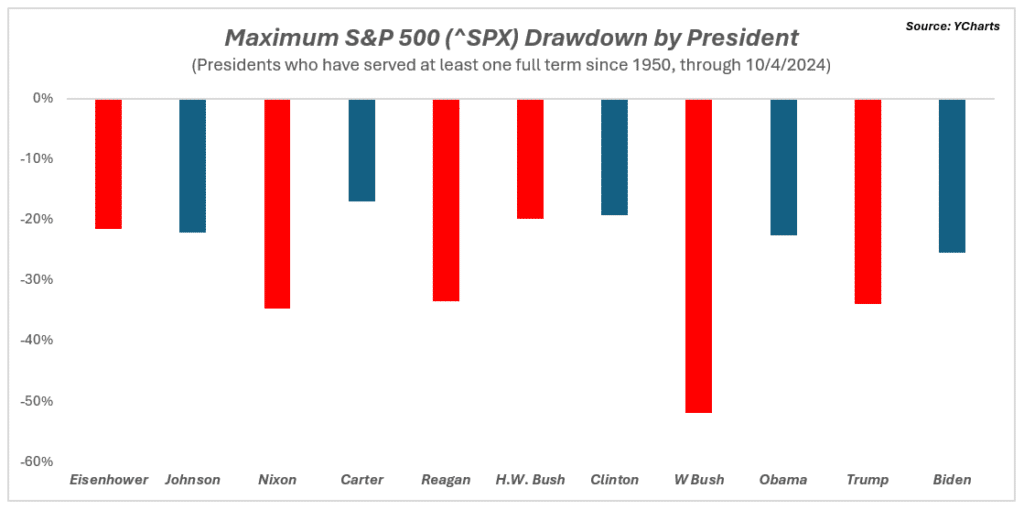

Perhaps more impressive, presidents who served at least one full term since 1950 have seen an average arithmetic return of more than 73% during their time in office.

This is despite the fact each president in this group saw, on average, a drawdown of more than 25% at some point during their presidency. Two presidents saw drawdowns of more than 33% and still were able to finish with positive returns.

The S&P 500 (^SPX) has also repeatedly shown great resilience, and in many cases complete immunity, from major negative and/or polarizing events involving Presidents.

| Event | Date | Event Day S&P 500 Performance | Next Day S&P 500 Performance |

| JFK Assassination | 11/22/1963 | -2.81% | 3.98% |

| Nixon Resignation | 8/8/1974 | -1.31% | -0.87% |

| Reagan Attempted Assassination | 3/30/1981 | -0.27% | 1.28% |

| Clinton Impeachment* | 12/19/1998 | — | 1.25% |

| Bush-Gore Official Results | 12/12/2000 | -0.65% | -0.82% |

| Trump Impeachment (1st) | 12/18/2019 | -0.04% | 0.45% |

| January 6, 2021 | 1/6/2021 | 0.57% | 1.48% |

For Americans that have lived through these events, the memories of these dramatic days are probably much more potent than the relatively benign market movements that actually took place.

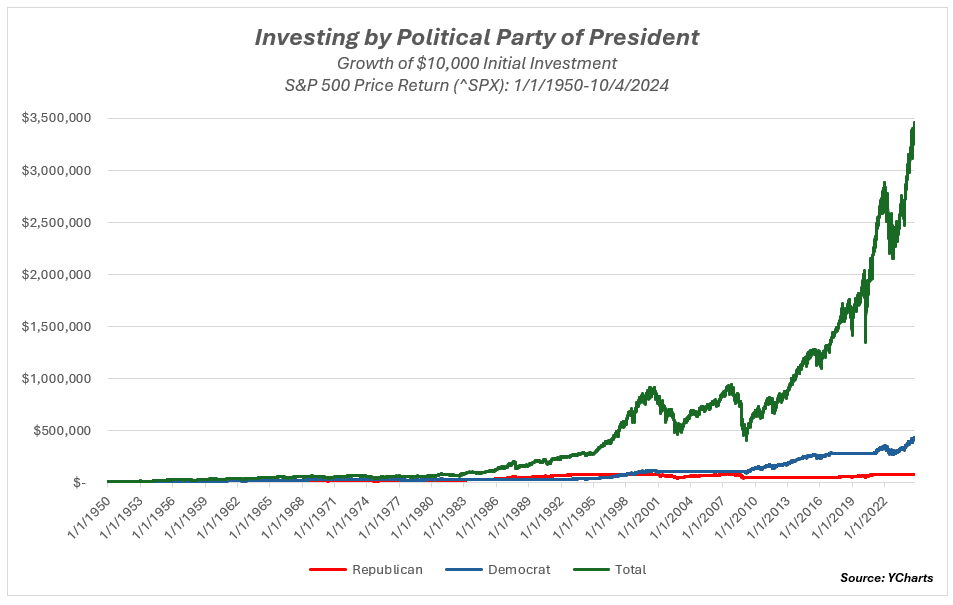

Perhaps the most straightforward way to present the case that the stock market is not highly correlated to the president or political party is to compare the cumulative performance of Republican vs. Democratic presidents since 1950.

Imagine you had $10,000 to invest on January 1st, 1950, and you decided you would only invest in the S&P 500 (^SPX) when your preferred party was in the White House.

If you only invested when Republicans were in office, you would have around $80,000 today. Not bad, about 8x your original investment.

If you invested only when Democrats were in office, you would have roughly $428,000 today. Even better- multiplying your original investment by 43x.

However, if you simply invested your $10,000 at the start of 1950 and never touched it again, today would have just over $3.45 million. More than $345 for every $1 you invested in 1950!

If you invested only with Republicans or only with Democrats, you saw positive returns; however, both options would have quite literally left MILLIONS on the table!

Hindsight is 20/20

Too often we look back in disbelief at the illogical actions of the past with little consideration for how our present-day choices will be judged in the future.

We criticize colonial-era Salem with no consideration for how the same biases and group allegiances are clouding our critical thinking today.

While it is easy to get caught up in the emotions of election season, perhaps the most thoughtful action you can take this November (aside from voting) is actually conscious financial inaction.

Cold, hard historical data has shown that the president has little impact on stock market performance. Whether your political tribe is happy or sad come Wednesday, November 6th, your feelings about your investment portfolio should be exactly the same.

As is usually the case with long-term investing, keeping things simple and sticking to your plan is often one of the best antidotes to the ever-present noise and chaos trying to knock you off course.