Media

How Worrisome Are Recent Economic Reports? Money Pros Weigh In.

Disappointing hiring numbers. Unemployment inching up. Steep tariff announcements. Weakening manufacturing activity. Periodic market volatility. If you are an investor, the past couple of weeks have brought

Can you get a tax break for selling your house at a loss?

If you’re hoping for a tax break for selling your house at a loss, the rules will probably disappoint you. In most cases, the IRS doesn’t

6 ways the new tax law could reduce your 2025 taxes

The sweeping new tax and spending bill that President Donald Trump signed into law on July 4 contains numerous new provisions and will have a major impact

With stocks at record highs highs, financial advisors warn not to chase the market. Do this instead

With the stock market near record highs, investors may be itching to go all in— but the last thing they should be is reactionary, according

What You Should Know About Micro-Retirement, Gen Z’s Newest Financial Independence Strategy

Work as we know it is evolving. Whether it’s a business, side hustle or traditional career, how we earn, build wealth and eventually retire is

Advisors Weigh In on Trump’s ‘Big, Beautiful’ Bill

While some tax saving aspects could benefit clients, advisors said other provisions could negatively impact the economy at large.

Stocks rise in choppy trade after Fed keeps rates unchanged

Equities rose in a volatile session on Wednesday but U.S. Treasury yields fell after the Federal Reserve left interest rates unchanged while warning of higher

Analysts react to Federal Reserve holding rates steady

The Federal Reserve held interest rates steady on Wednesday but said the risks of both higher inflation and unemployment had risen, further clouding the economic outlook as

Why the Bond Market’s Not Acting as It Should

Typically, when investors leave equities, they head for fixed-income… typically. Equity markets were rattled after the Trump administration announced sweeping tariffs earlier this month, and

Wall Street searches for elusive signs that market bottom reached

Investors are looking for signs the selling in the U.S. stock market may have reached a crescendo, but say that the check marks are not

Financial advisors respond to the rise in recession talk

The “R”-word, as in recession, has been popping up lately across trading desks, financial media and even the White House, where President Trump this week refused to

Should I pay off my tax debt before my credit card debt? Experts weigh in

If you’re one of the many Americans in credit card debt, you might also get some unfortunate news this tax season and realize that you owe

Are value stocks finally taking the baton from growth?

There have been a lot of dropped handoffs over the past few years, but growth stocks finally look like they are passing the baton to

Pension fund managers brace for a risky market, new survey finds

A wide majority of pension fund managers are warning that investors could be in for a bumpy ride this year. Roughly 8 in 10 fund

Let’s Navigate the American Health Care System

Americans make about 150 million trips to emergency departments each year. Their bank accounts wish they made far fewer.

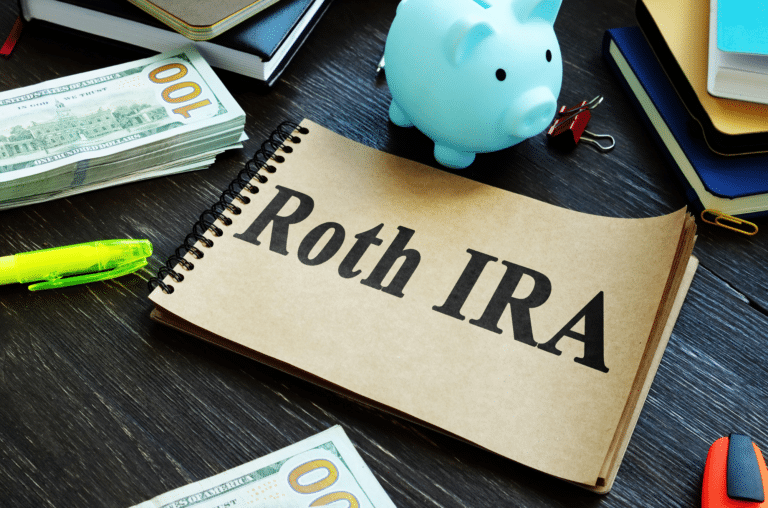

Low Taxes Under Trump Sweeten Roth Conversions

Many investors could benefit from converting tax-deferred retirement assets to a tax-free Roth individual retirement account but are hesitating because they don’t want to pay

RIAs confident, not complacent, about market gains after election

RIAs felt more optimistic about the economy and stock market following the US election in November, a new study showed. But a number of financial

Attention, Taxpayers: Read This to Avoid Late Penalties on Estimated Taxes

If you didn’t make your estimated fourth-quarter tax payment for 2024, there is still time to square up with the Internal Revenue Service and avoid

How advisors are finding fixes for retirees squeezed by inflation

Retirees and pre-retirees sitting down for breakfast are getting squeezed. And their financial advisors are finding that it’s not just their orange juice.

Celebrating Pennsylvania’s Best Places to Work

Lehigh Valley Business, in partnership with Best Companies Group and Central Penn Business Journal, once again hosted its annual Best Places to Work in PA