In June of last year, a man named Geoffrey Holt died at the age of 82. He lived by himself in a trailer park in New Hampshire and lived “very frugally”. He died with $3.8 million and left it all to charity. Nine years before him, a man named Ronald Read died at the age of 92. He spent most of his life working as a janitor and gas station attendant. When he died, he had an estate valued at almost $8 million. He, too, left most of it to charity. I admire people like him and Geoffrey Holt, but I also wonder if they accumulated so much money because they lived in fear of running out of it? Maybe they could have given some of their money to charity during their lives and seen the benefits of that giving? Maybe they could have made their lives a little bit easier?

Ask most people what they fear about retirement and it usually revolves around some form of running out of money. While that is a legitimate fear, that fear can lead to some unintended consequences. It could mean delaying your retirement “just one more year”. Maybe your retirement goals will go unfulfilled and your bucket list untouched. You spend your retirement worrying about having enough or spending too much.

Fear of Spending Money in Retirement

This fear is normal. Most people spend their entire adult lives in “savings mode” preparing for retirement. It is emotionally challenging to switch from “savings mode” to “spending mode”. You are trying to reverse a lifetime of (good) habits – saving, living below your means, preparing for the future. As we start the new year and decide on some new habits in the form of New Year’s resolutions, we know how hard it is to start a new habit or break an old one.

Before you get excited, this blog post is not about forgetting those good savings habits, living in the moment, and worrying about the future later. I’m a financial planner. It’s my job to worry about the future. But the more I do this job, the more I think about striking a balance between saving for the future while living a fruitful life during your working years. This is a habit that can then seamlessly continue into retirement.

The Balance Between Overspending and Underspending

A few years ago, there was a popular book titled “Die With Zero: Getting All You Can from Your Money and Your Life ” by Bill Perkins. The premise is to live your optimal life throughout your life and not just wait for retirement. He wants to save you from over-saving and under-living. Of course, when you’re an energy trader for a hedge fund worth tens of millions of dollars, that is easy to preach. I’m sure I could figure out a way to live an optimal life if I had more money than I knew what to do with. Nevertheless, his general message is a good one. Buying stuff you like, particularly experiences, is ok. Just as long as you’re also saving money. Everything in moderation, right?

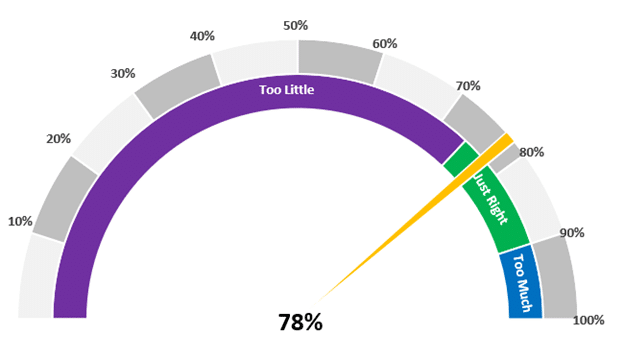

I wish I had the answer to striking that perfect balance between overspending and underspending or saving too little versus saving too much. I don’t. But through the financial planning process, we seek to provide directional guidance towards that middle ground. We do this through what’s known as a Monte Carlo analysis (named after the Monte Carlo casino which is known for its game of chance).

Monte Carlo Simulation for Retirement

A Monte Carlo analysis considers the inherent uncertainty in predicting future market returns and economic conditions. It then comes up with a probabilistic score ranging from 0% to 100% that you will be able to enjoy your desired standard of living throughout retirement without the need to make any adjustments.

When thinking about this, nobody wants a score of 0% and many people want a score of 100%. Who doesn’t want to score 100% on a test? The problem with making 100% your goal is to achieve that, you need a lot of “cushion”, or extra assets, to protect against the worst case. In other words, you need to live substantially below your means. It’s the equivalent of living “risk-free”. To own a risk-free investment, you must accept a lower return. The same is true in life – if you want to eliminate your risk of running out of money, you must accept a lower return on the investment of your human capital during your working years.

In his book The Retirement Planning Guidebook, Dr. Wade Pfau uses the analogy of mountain climbing when planning for and spending in retirement. With retirement planning, we think of the goal as accumulating enough savings to retire (i.e. climbing the mountain). But you also need to make it back down the mountain safely (i.e. spending in retirement). He points out that more accidents happen on the way down the mountain than on the way up.

Living in Retirement & Finding Your Middle Ground

As financial planners, it’s our job to educate people on the rewards of a life well lived, the inherent risks associated with it, and how best to protect against those risks (e.g. having an ample supply of cash to fund short-term needs). We’re well aware of the risks of saving too little that it can blind us to the risk of saving too much.

This is not a proclamation to spend for the sake of spending. It’s encouragement to think of those bucket list items as not out of the realm of possibility. Or maybe giving money to your children or favorite charity during life so you can see their enjoyment and use of the funds. If we succeed, our clients should feel comfortable in that middle ground.

I’ll never know what went through Geoffrey Holt or Ronald Read’s minds but what I do know is that they would have scored a 100% on their Monte Carlo analysis. Who am I to say that is wrong? Maybe that’s what they would have wanted. As long as I was able to communicate the pros and cons of that result, I would have done my job.

Behind all the data, tax calculations and investment advice, my fundamental job is to help people live their best lives without being in a constant state of worry. I try to help them understand why a 78% result is not bad and doesn’t mean there is a 22% chance they will die broke. While I don’t want anyone to “die with zero”, I also don’t want them to die with $10 million they would have liked to spend.