The Silent Generation, those born between 1926 and 1945, account for approximately 30 million people in the U.S. The next generation after the Silent Generation, those between the ages of 45 and 65, are becoming known as the “Sandwich Generation”, due to their roles in helping their kids and their aging relatives. Oftentimes this generation isn’t aware of what’s on the minds of their aging relatives. As we live longer, having a proactive aging plan, helps this generation and the younger generation avoid crisis that can occur.

Four areas that are on the minds of aging relatives are:

- They don’t want to run out of money.

- They don’t want to be a burden on their family as they age.

- They want to be remembered; they want their life to have had meaning.

- Spiritually, they want to have a fulfilling faith.

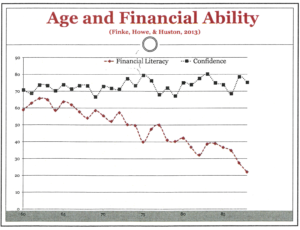

Unfortunately, the elderly can be preyed upon, due to cognitive decline resulting from the aging process. Texas Tech University and the University of Missouri did a study on financial cognitive ability as we age. The below chart details their findings. As we age from age 60 on, our financial decision-making declines, yet our confidence that we are making good decisions increases over time. This may be why the elderly are vulnerable to being exploited financially.

Source: Finke, Michael S. and Howe, John S. and Huston, Sandra J., Old Age and the Decline in Financial Literacy (August 24, 2011).

Having an aging plan conversation can head off potential issues. Most people want to age in place and not leave the homes they have raised their families in. Plan on whom will help maintain the home, how to outfit the home to first-floor living, if required, what caregiving resources will be required to help with the aging process and who will fill these roles. Tally up the cost of all these areas. Also, talk about the backup plan. What would be the alternative if some life event happened and the original plan didn’t work out? The Silent Generation may not be talking about all of this, but they do think about it.

Bringing the family together to discuss three areas can head off future misunderstandings.

1) Estate Documents – What estate documents are in effect, who will fulfill the different roles and have laws changed since the documents were signed? Documents to consider:

- Will – Who is the executor and what work is involved with this role? Will this person be paid?

- Powers of Attorney’s – Who will fulfill this role and what specific power does this person have? When will this power be implemented?

- Health Care Directives – Who makes these decisions, what criteria need to happen and what are the wishes of the person. For all of these roles does the person want to fulfill the duties.

2) Financial – What is a general overview of the financial assets and debts? Is there one place to find all of this information? Are beneficiaries of retirement plans, pensions, life insurance and annuities up to date? Are non-retirement assets titled correctly per the estate documents? When was the last time all of this was reviewed?

3) Aging Plan – Who will help with driving to doctors, make sure medicines are taken as prescribed, help with understanding medical choices, help with activities of daily living? When will it be time to stop driving and how will independence still be maintained?

If you have more questions or would like support as you navigate aging relatives, the CERTIFIED FINANCIAL PLANNERTM professionals at Marshall Financial can help answer them. Click here to contact us.