If you’ve been reading articles about financial strategies to consider in a down market, you’ve probably come across advice on Roth conversions. However, just because a strategy works in a down market, doesn’t mean it’s always best for your situation. Here are some key points to consider before you decide to fight the bear-market blues with a Roth IRA conversion.

What is a Roth Conversion?

A Roth conversion is the direct transfer of assets from a Traditional IRA or 401(k) to a Roth IRA. The fair market value of the assets transferred, less any basis[1], is subject to ordinary income tax in the year of conversion. Once the assets are in the Roth IRA, they are no longer subject to income tax.

Why is a Down Market a Good Time for a Roth Conversion?

The Lower the Fair Market Value, the Less Tax You Pay

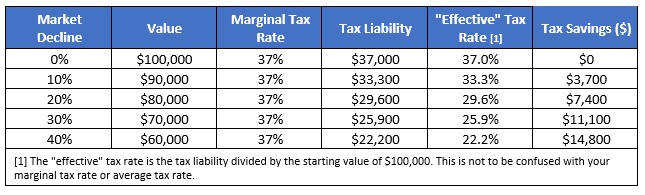

Since tax is assessed on the fair market value of the assets transferred, you can transfer the same number of shares, albeit at a lower value, and pay less tax. This can be a great savings tactic if you feel the transferred assets were fairly valued before the drop in value and are now undervalued.

Converting $100,000 worth of stock back in January that is now worth $80,000 would save you $7,400 in taxes to convert the same number of shares. While you are still subject to a marginal tax rate of 37%, you only pay an “effective” tax rate of 29.6% on what you feel is the fair value of that asset ($100,000).

The chart below illustrates these savings at various market decline levels.

Future Appreciation Occurs in a Tax-Free Vehicle

Once assets are converted to a Roth IRA, all future appreciation is tax free. As asset classes decline in value, which they have so far this year, expected future returns of those asset classes increase. A future return expectation of 6% back in January could be adjusted to 7-8% to account for the decline in value so far this year. That projected increased appreciation will now take place in a tax-free vehicle.

Of course, mentioning market returns requires a word of caution. We do not advocate trying to perfectly time your Roth conversions with market declines. To avoid trying to time the market bottom, you could consider converting over a fixed period of time (e.g. monthly, quarterly) and tweaking those fixed conversions depending on market conditions.

Is a Roth Conversion Right for Me?

Just because a drop in market value makes it a good opportunity to convert Traditional IRA or 401(k) assets to a Roth IRA, it does not mean it’s the right strategy for everybody. Ask yourself the following questions before pursuing this strategy.

1. Do You Have the Money to Pay the Conversion Tax?

Every pre-tax dollar converted to a Roth IRA is subject to income tax in the year of conversion. To preserve the assets within your accounts, consider paying this tax with cash or assets held outside of your retirement accounts.

2. Do You Have a Long Time Horizon to Let the Funds Appreciate Tax-Free?

In short, the longer your time horizon, the bigger the benefit of a Roth Conversion, because it allows for longer, tax-free growth. The tax paid up front is the short-term pain for the long-term gain of future tax-free appreciation.

3. Are You Currently in a Low to Mid Tax Bracket?

If this is a year where you expect to be in a lower tax bracket, or you expect to be in a lower tax bracket soon, those years are good opportunities to consider a Roth Conversion. Recent retirees who are no longer earning income but are not yet taking social security or required minimum distributions from their retirement plans are a good example.

4. Would You Like to Leave an Income Tax-Free Inheritance to Your Kids?

Roth IRA assets, while still subject to the Federal Estate Tax and/or state estate or inheritance taxes, retain their income tax-free nature in the hands of the beneficiary, so any distributions to them remain tax free. On the other hand, distributions from Traditional IRAs are taxable to beneficiaries the same way they’d be taxable to you.

5. Do You Want to Diversify Your Future Tax Exposure?

There are three broad tax categories for investment accounts: Taxable (e.g. brokerage account), Tax-Deferred (e.g. Traditional IRA), and Tax Free (e.g. Roth IRA). Like the stock market, we can’t predict future tax policy with any certainty. One way to hedge that uncertainty is to diversify your holdings among the three tax categories just like you’d diversify your investment holdings among asset classes. Adding some eggs via a Roth Conversion to your tax-free basket can be a good way to do that.

[1] You acquire basis in your Traditional IRA or 401(k) by making after-tax contributions. Basis is allocated on a pro-rata basis to the assets converted.