If you’re self-employed, you have a few options when it comes to saving for retirement. You want to be sure you’re maximizing your savings, but it can get overwhelming with IRS limits, tax filing, and choosing the right savings plan for you – all while maintaining your business.

In this blog, we’ll compare two self-employed retirement plan options: the Solo 401(k) and the SEP-IRA.

What is a SEP-IRA?

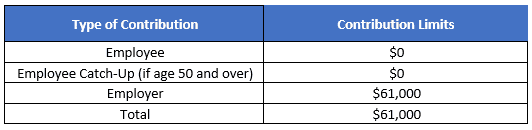

A SEP-IRA is a type of retirement plan for self-employed individuals. You can contribute 20% of your earnings up to $61,000 (the 2022 IRS limit). SEP-IRAs do not allow catch-up contributions. All contributions are considered employer contributions and contributions must be made pre-tax.

Setting up a SEP-IRA is simple and there are no annual filing requirements.

What is a Solo 401(k)?

A Solo 401(k), also known as an Individual 401(k) or One-Participant 401(k), is a retirement plan option for self-employed business owners, including S-Corp owners, with no employees other than a spouse. It is also an option for those with secondary incomes, such as consulting.

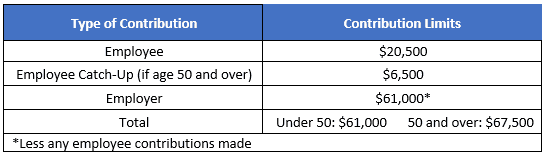

The Solo 401(k) operates in a similar fashion to a traditional 401(k) plan. It allows both employee and employer contributions (being self-employed, you wear both hats) and has a maximum annual contribution limit for 2022 of $61,000 (plus a catch- up contribution limit of $6,500 if age 50 and over).

Learn more about Solo 401(k)’s here.

SEP-IRA or Solo 401(k)?

If you are self-employed, you have two main options if you’re interested in setting up a retirement plan – a SEP-IRA or Solo 401(k). A SEP-IRA is more popular given its ease of set up and lack of annual filings, but depending on your goals, a Solo 401(k) might be a better option. There are three main differences between them that we highlight below.

Contribution Limits

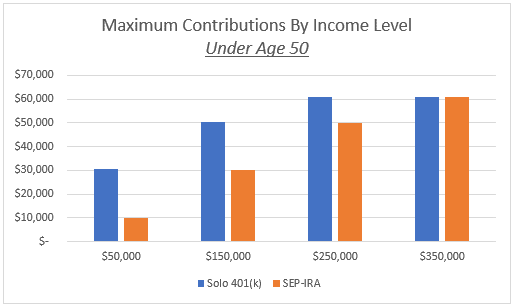

Higher Contribution Limits – Solo 401(k)s allow employee contributions (100% of earnings up to $20,500) and employer contributions (20% of earnings up to $61,000, net of employee contributions). If you are age 50 and over, you can also make a catch-up contribution of $6,500. SEP-IRAs only allow employer contributions subject to the same employee and employer contribution limitations and no catch-up contributions. The advantage of these additional contributions offered by a Solo 401(k) is particularly evident at lower income levels but goes away entirely once your income exceeds $305,000. At that point, 20% of your income is equal to the maximum limit of $61,000. The one exception is the catch-up contribution, which means if you are age 50 and over, you’ll always be able to contribute at least $6,500 more to a Solo 401(k) than a SEP-IRA.

Roth Contributions

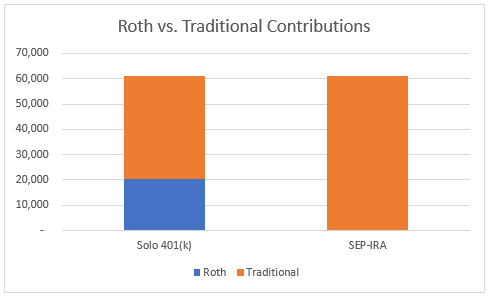

You can make Roth contributions (up to $20,500 plus catch-up) to your Solo 401(k) with the employee contributions. You cannot make Roth contributions to a SEP-IRA.

The ability to make Roth contributions is a great way to diversify your tax exposure. Similar to the advice to diversify your investment allocation across a mix of stocks and bonds, we believe it’s good practice to diversify your retirement tax exposure between tax-deferred and tax-free assets when possible.

Another benefit to Roth contributions is to build up a tax-free bucket for either later consumption or an income tax-free inheritance to the beneficiaries. The longer you can let money grow tax free, the bigger the benefit can be. We frequently advise clients to think of tax-free assets as the last bucket of assets to draw down in retirement. If you are fortunate enough to never need those assets, they will pass on to your heirs income tax-free. If you’re unsure of using this strategy on your own or would like the convenience of someone guiding you through estate planning strategies, be sure to contact a wealth advisor.

Annual Filings

Once assets exceed $250,000 in a Solo 401(k) plan, you must file an annual form (Form 5500-EZ) with the IRS. While the form is only two pages long and relatively straight-forward, it may not be something you are keen on doing yourself, in which case a CPA should be able to help.

With a SEP-IRA, there are no annual filings regardless of the level of assets. This helps make the administration of a SEP-IRA a breeze. Sometimes simplicity is the biggest advantage of all.

Conclusion

If you are self-employed, you have two main options – a SEP-IRA or Solo 401(k). A Solo 401(k) is particularly beneficial for those looking to maximize their retirement savings and have income below $305,000 or desire to make Roth contributions. For those making more than $305,000 and prefer simplicity over the ability to make Roth contributions, a SEP-IRA may be the better option given its lack of annual filing.

Want to learn more about planning for your retirement? Download our guide, Planning Early for Retirement to get our retirement needs checklist and decade-specific advice for planning from your 30’s to your 60’s and beyond.