What is your credit score?

Your credit score (FICO) is an assessment of your ability to repay debt. Banks and other lenders use it to help decide if you will be approved for a credit card or loan. A lower score can make it harder for you to be approved or get the lowest interest rates on a loan. Your credit score is based on your credit history, which includes things like the length of your credit history, percent of available credit used and your payment history.

You can get your credit score in a variety of ways.

- You can request a free credit report at annualcreditreport.com

- Check your credit card or loan statement. Many companies have begun providing your score on your monthly statement

- You can obtain a score directly from one of the credit reporting companies.

- Transunion https://www.transunion.com/

- Equifax: https://www.equifax.com/personal/

- Experian: https://www.experian.com/

- You can get it from a credit reporting service – some are free and others charge a fee.

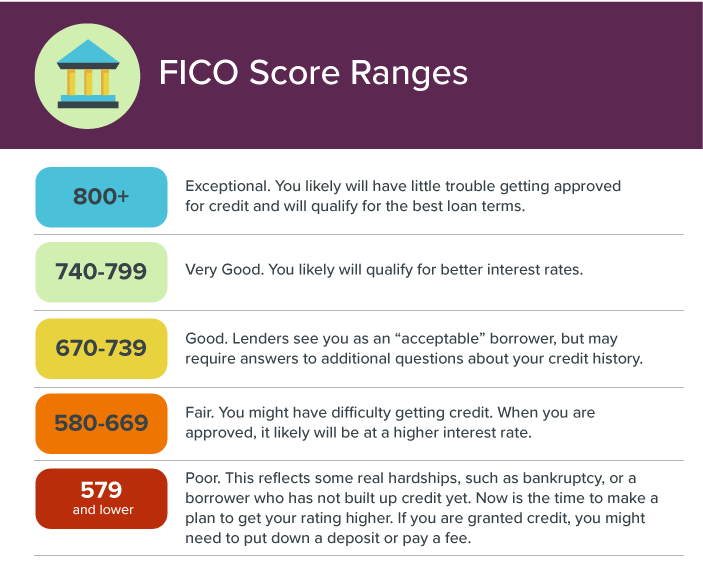

This chart from Smart About Money shows the range of credit scores and how lenders view them.

Source: https://www.smartaboutmoney.org/Courses/My-Financial-Well-Being-Plan/Size-Up-Your-Credit-Score